In 2013, transaction volume of China commercial banks exceeded 124.54 billion with e-banking replacement rate of 79%. China commercial banks are now focusing on mobile payment and it is estimated that they will be transformed into the mechanism based on e-bank online payment, assisted by phone payment, self-service terminal, WeChat payment banks and various e-channels in the future.

iResearch estimates that in 2014, total transaction volume of China commercial banks will be 142.31 billion with e-banking replacement rate of 80.3%. It is believed that e-banking service satisfies much need for users and with internet’s rapid development and users are more dependent on e-banking. However, the high replacement rate indicates China commercial banks need to adjust their e-banking business.

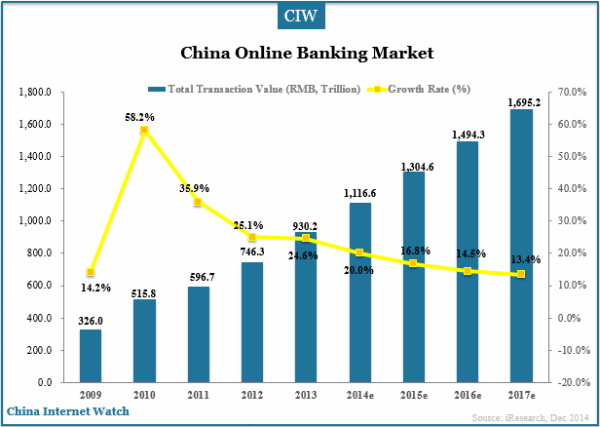

China online banking transaction value reached RMB930.2 trillion (US$151.25 trillion) with an increase of 24.6% in 2013. China online banking market will still keep rapid development while its growth will slow down.

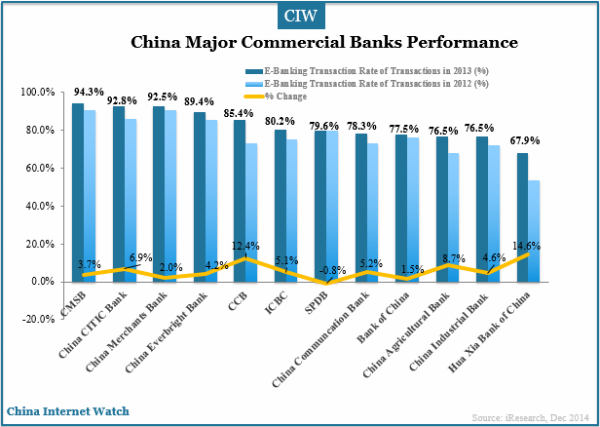

In 2013, China major commercial banks’ e-banking relacement rate of transactions had increased from 2012. The top 3 commercial banks were Minsheng Bank, China Citic Bank and China Merchants Bank with e-banking replacing rate of transactions of 94.3%, 92.8% and 92.5% respectively.

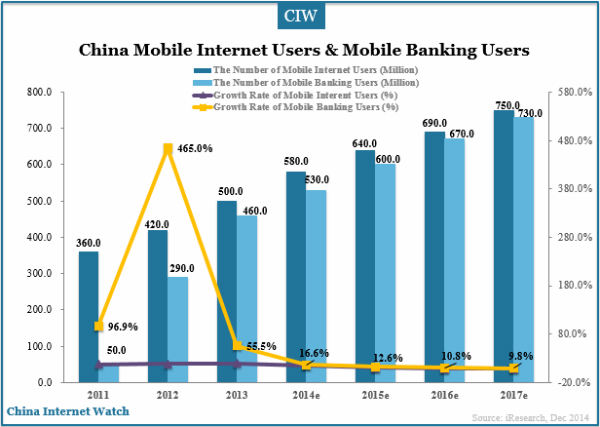

In 2013, China mobile banking users exceeded 460 million with an increase of 55.5% YoY, and the gap from the scale of total mobile internet users narrowed. iResearch believed that in 2017, the number of mobile banking users will be over 700 million.

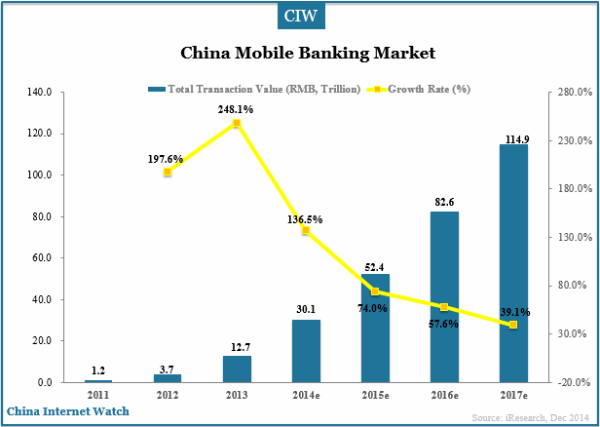

In 2013, total transaction value of China mobile banking market was RMB12.7 trillion (US$2.06 trillion) with an increase of 248.1% YoY. The high growth of mobile banking service will maintain for 3 more years and in 2017, the number of transaction value will be over RMB110 trillion (US$17.88 trillion).

In 2014, personal online banking users, mobile banking users, mobile phone banking users and Wechat banking users accounted for 35.6%, 17.8%, 12.9% and 6.8% respectively.

There are 3 reasons for rapid development of China mobile banking market:

- The large number of China mobile banking users stimulated the overwhelming growth of transactions on mobile

- Various China banks had promotions on mobile banking service which drive users’ engagement

- Using mobile banking service is now a habit among many bank users in China

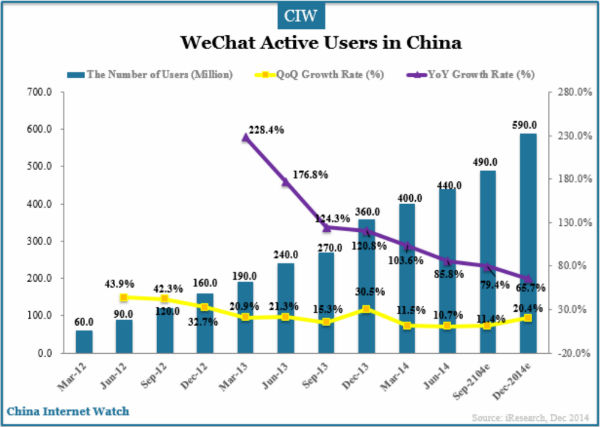

As of Dec 2013, WeChat active users exceeded 360 million with an increase of 120.8% from the same period of prior year. It is estimated that as end of 2014, Wechat users will be over 590 million.

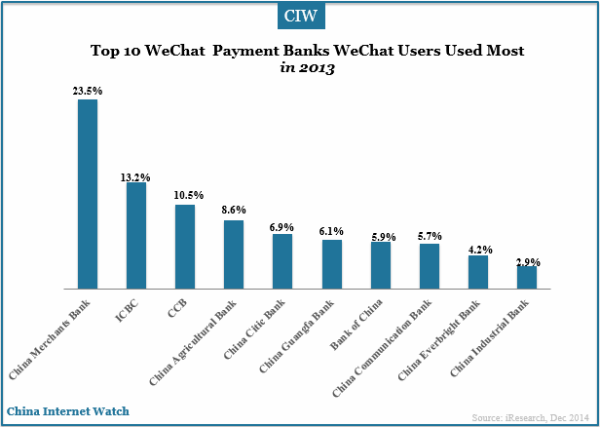

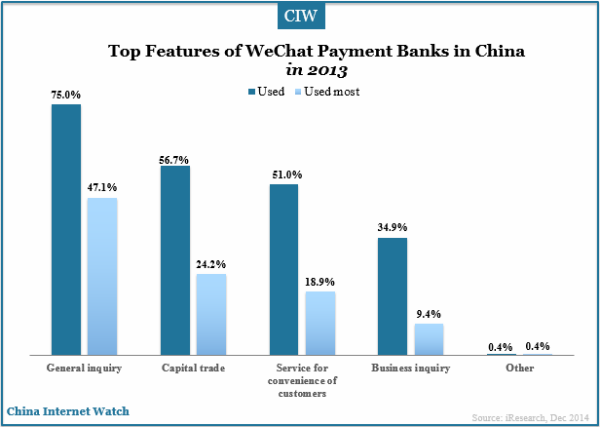

Top 3 WeChat payment banks that WeChat users used most were China Merchants Bnak, ICBC and CCB in China in 2013. Generic banking inquiry service was the major feature for China WeChat users, representing 47.1%, followed by capital trading and service for convenience.

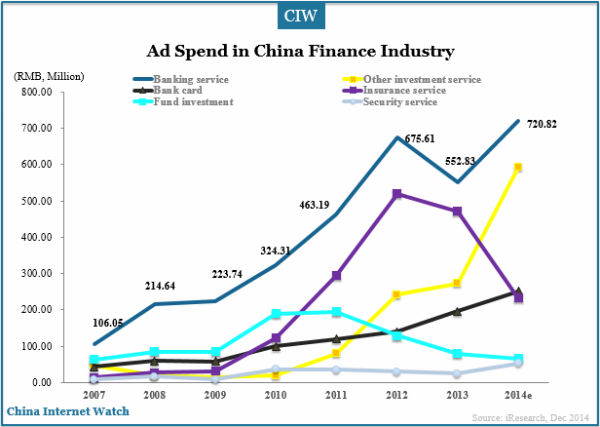

In 2013, China finance industry advertisers increased ad spend on bank card and other investment service while reducing ad spend on other services. Ad spend on fund investment decreased the most with rate of 38.9%, followed by banking service (18.2%) and security service (18.1%).

In 2013, top 3 service by ad spend were banking service, insurance service and other investment service. While in Oct 2014, China Construction Bank spent RMB16.37 million ($2.67 million) in online advertising, the biggest advertiser in online display ads (excluding text link ads and some targeted ads), followed by China Industrial & Commercial Bank, Bank of Communication.

Also read: Insights of China Mobile Payment (Wechat, Alipay) Users