Since 2000, China automobile market has been developing rapidly. As of 2013, average sales volume of automobile increased by 19.8% annually in China. However, the growth slowed in recent two years. China Automotive Technology Research Center estimated that automobile sales volume will reach 25.5 million in 2015 and 35 million in 2020 with average annual growth rate of 7%.

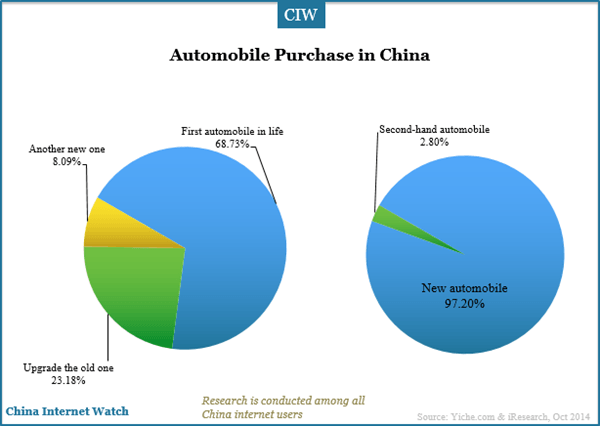

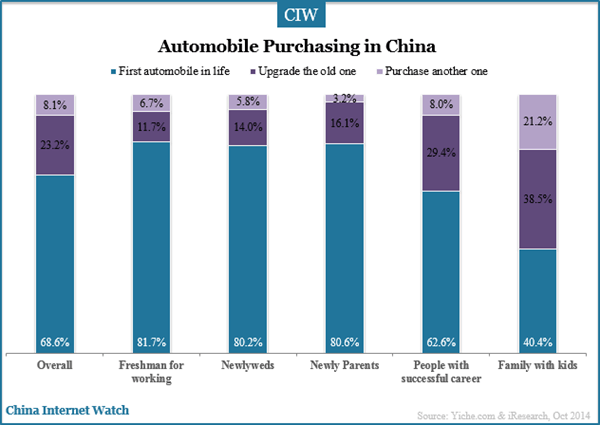

Among China internet users who purchased cars online, 68.8% of them bought their first automobile in life while 23.2% upgraded the old one. Besides, most China internet users would choose to buy new automobile other than second-hand one according to research conducted by iResearch and Yiche.com.

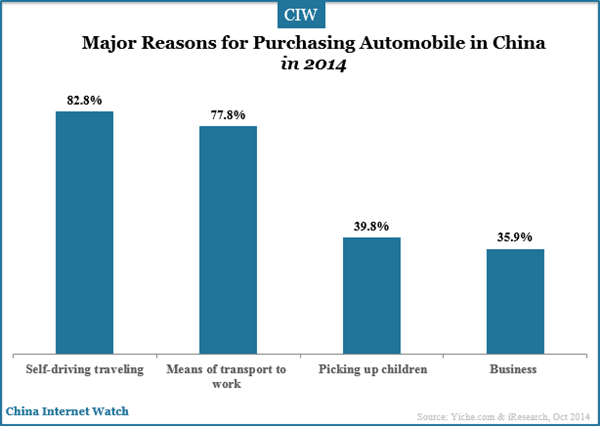

82.8% of respondents purchased automobile for self-driving trip while 77.8% for transportation to work.

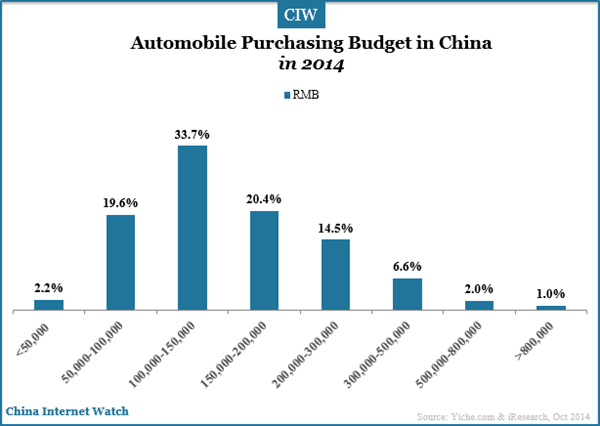

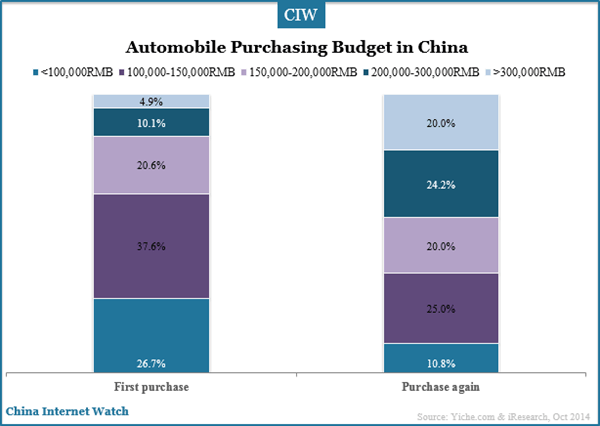

China internet users’ automobile budget is between RMB50,000 and RMB200,000 accounting for over 70% in 2014. Automobile has been the mass consumer product in China nowadays. 64.2% of China internet users who purchase cars again would choose the ones with price over RMB150,000 (USD 24,140).

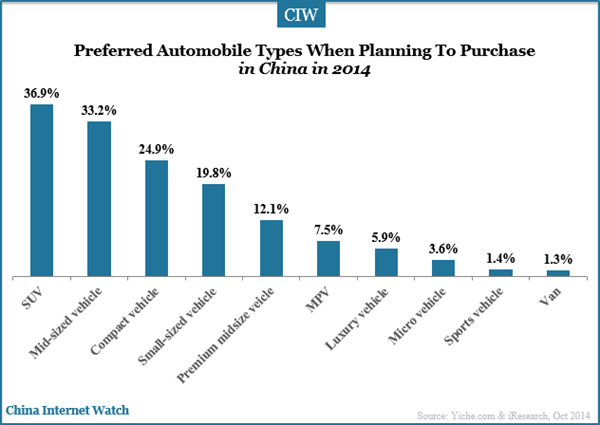

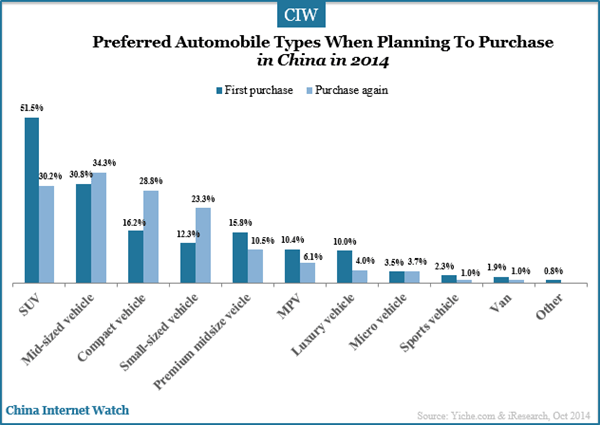

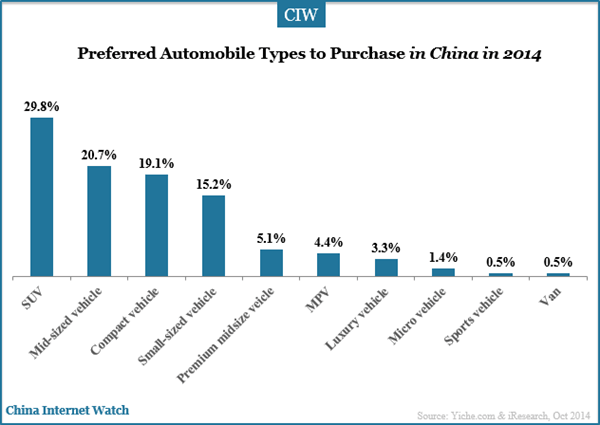

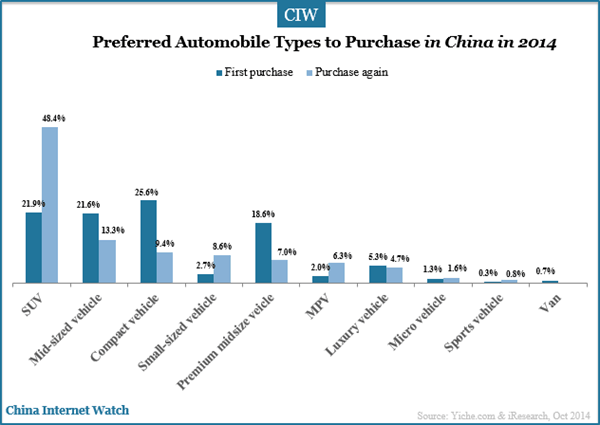

SUV was the first choice for most China internet users (36.9%) who planed to purchase automobile in 2014, followed by mid-sized vehicle (33.2%) and compact vehicle (24.9%).

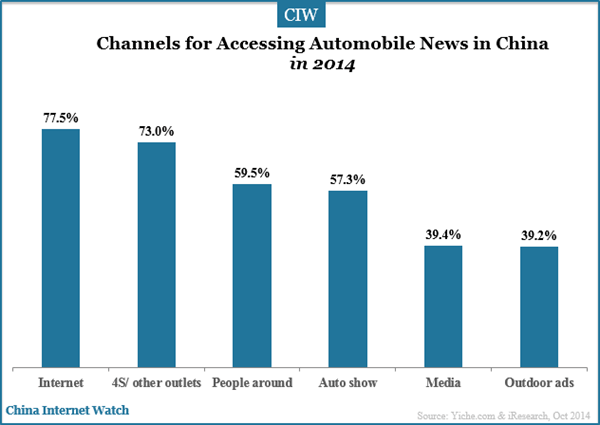

77.5% of China internet users gained automobile purchase information from internet. People around and auto shows can have also impact on automobile purchase while outdoor ads and traditional media have relatively weak influence.

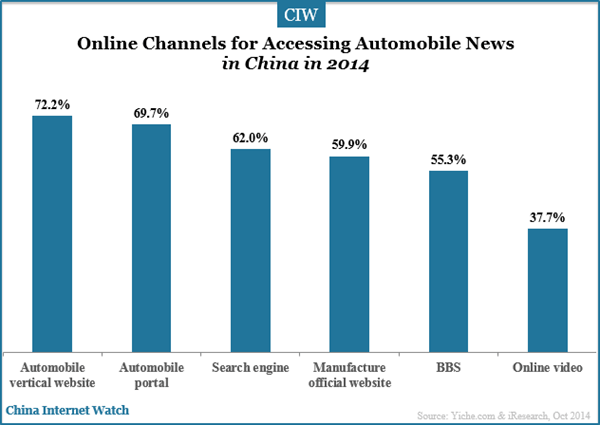

72.7% of China internet users would access automobile news on automobile vertical websites, followed by portals and search engine.

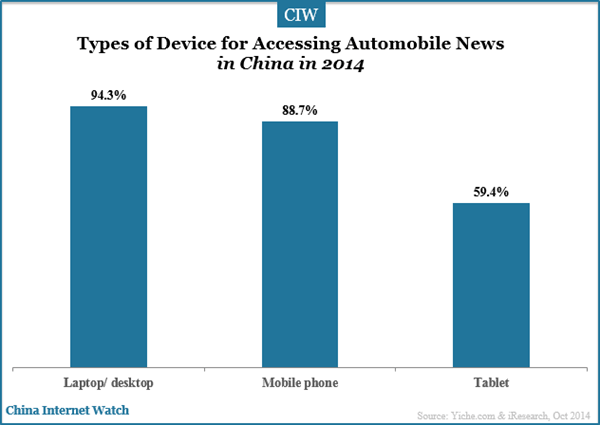

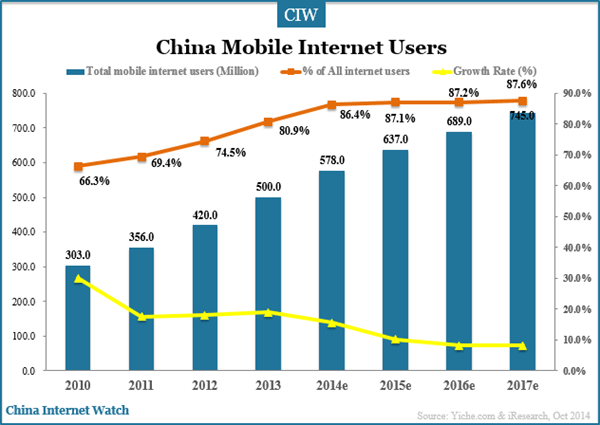

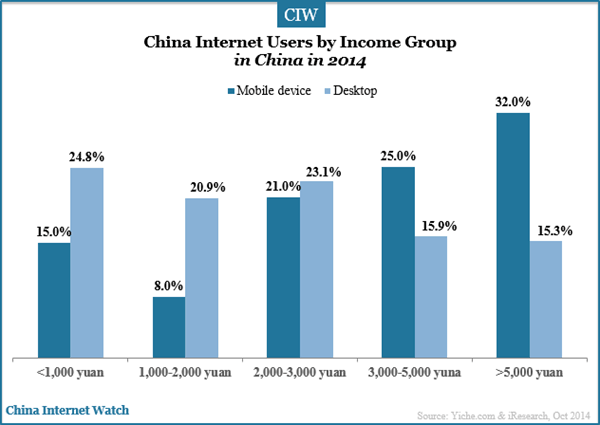

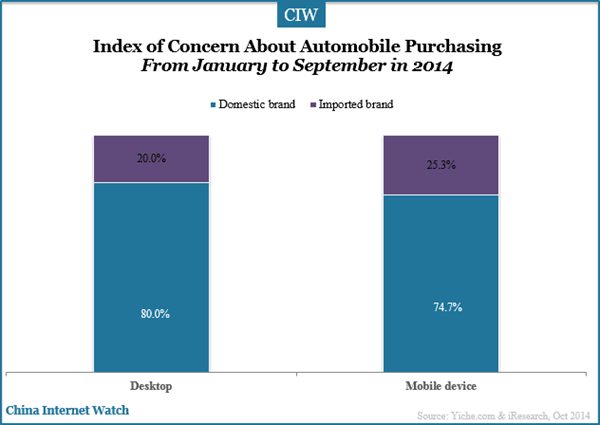

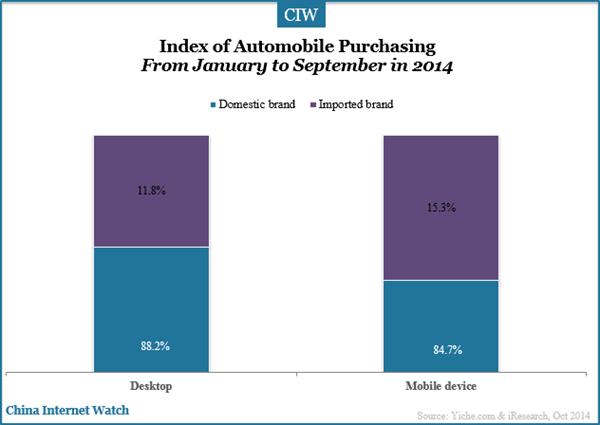

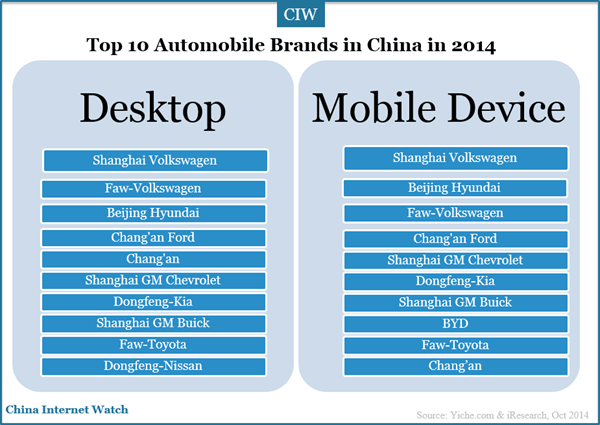

For most internet users in China who purchased cars online, cross-device access has become the mainstream. Desktop and laptops are still the most regular device for users to access automobile information. With China mobile internet’s development, mobile device are gradually playing a more important role than desktop.

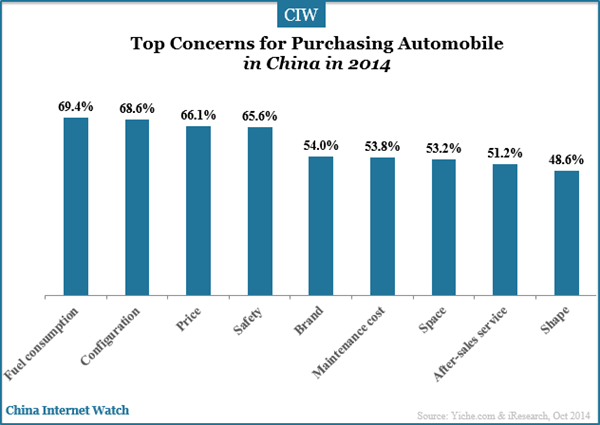

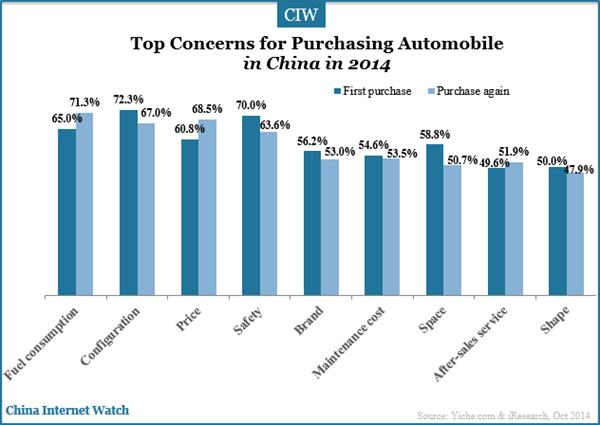

When purchasing automobile, China internet users’ top 3 concerns are fuel consumption, configuration and price. For first purchase of cars, China internet users focus on fuel consumption and price while for those purchase another automobile, they focus on automobile’s configuration, safety, space and brand.

In 2014, 29.8% of respondents bought SUV, which is the favored one for China internet users.

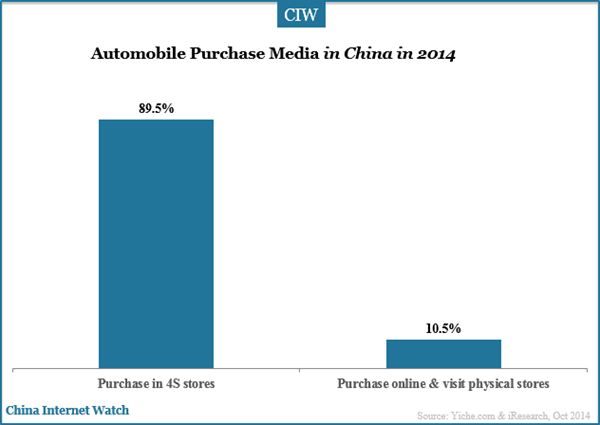

Among respondents who bought automobile in 2014, 89.5% of them purchased in 4S stores and about 70% of them are automobile vertical websites users. The way of purchasing automobile online is becoming popular in China as e-commerce is key part of Chinese people’s life.

Chinese users displayed the highest level of engagement and interactions with brands on social media, according to PwC research. And, a McKinsey survey pointed out that social media has a greater influence on purchasing decisions for consumers in China. During 14 days’ promotion on Weibo, a total number of over 60 thousand cars were ordered with a total worth of over RMB9.2 billion (US$1.5 billion).

In China, mobile internet users exceeded 500 million in 2013 with penetration of 80.9%. The growth rate of mobile internet users is higher than the one of total internet users.

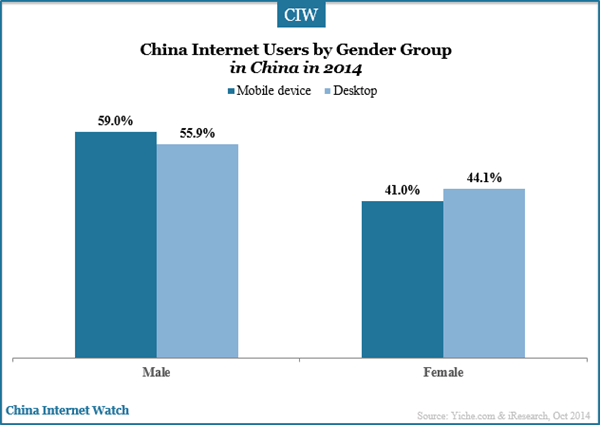

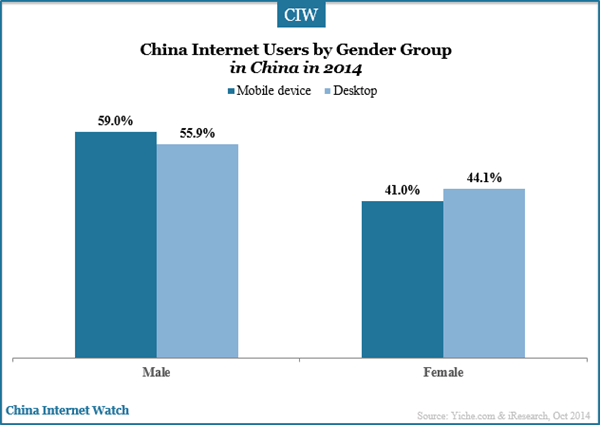

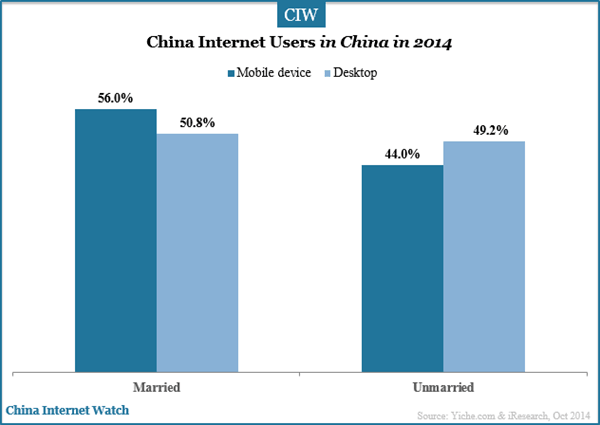

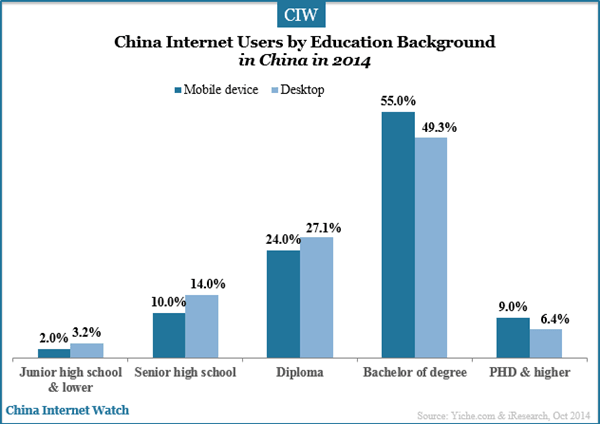

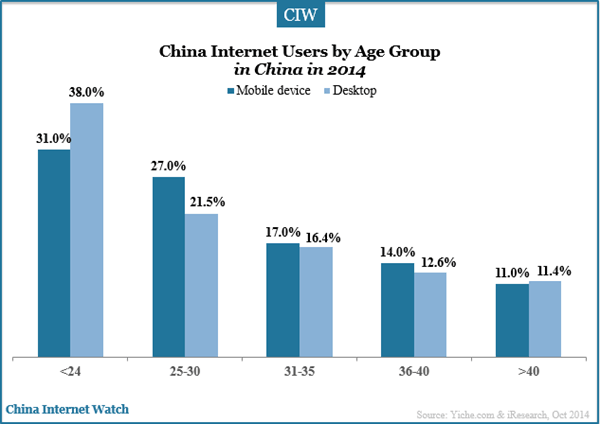

Compared with China internet users on desktop, the ratio of young male married ones with high education background, high income on mobile device is higher who tend to choose sports cars, imported automobile, and middle and high end automobiles according to iResearch data.

Here is a list of top 10 automobile brands on desktop and mobile device in 2014:

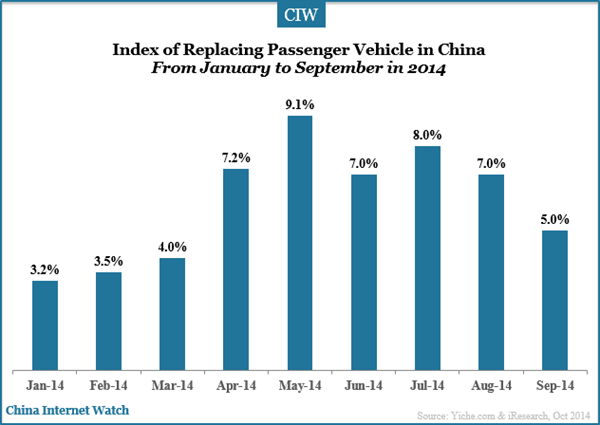

From January to September 2014, the index of replacing passenger vehicle in China continuously rose with monthly compound growth rate of 5.5% according to Yiche.

More online car buyers bought the first car online, especially among freshman for working, newlyweds and new parents. And people with successful career usually upgrade their old ones; family with more than one kid tend to purchase another one.