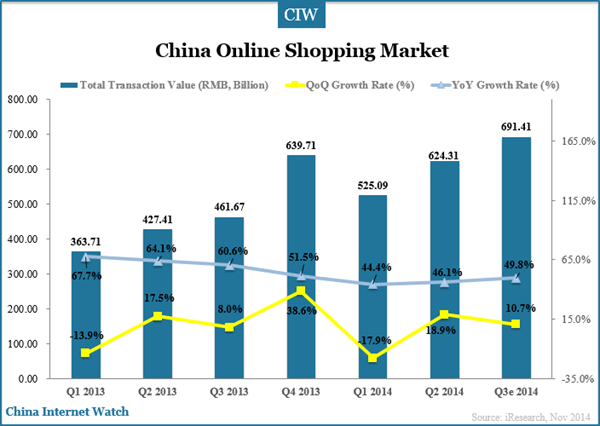

In Q3 2014, total transaction value of China online shopping market was RMB691.41 billion (US$112.69 billion) with an increase of 49.8% year on year. Total retail value exceeded RMB6.5 trillion (US$1.05 trillion) and China online shopping accounted for 10.6% of total consumer retail market according to data from National Bureau of Statistics of China.

China e-commerce companies are now not only optimizing logistics and after-sale services, but also actively making efforts in tier-3 & tier-4 cities even in rural China. Besides, international strategy and mobile shopping become new strength in online shopping market in China.

The online transactions generated by counties and villages in north China, central China and south China, have shown stronger growth momentum, accounting for 30% of the overall online transactions made by counties and villages in 2013 in China.

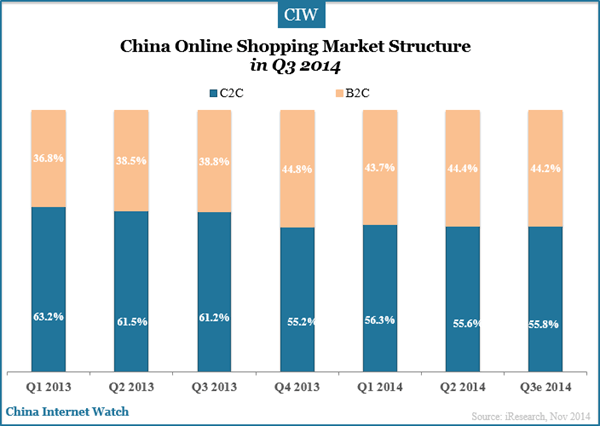

Total transaction value of China B2C market was RMB305.38 billion (US$49.77 billion), representing 44.2% in online shopping market in Q3 2014. China B2C market value in Q3 2014 increased by 38.8% from the same period of prior year and increased by 70.4% year on year, much more rapid than growth rate of C2C market.

Total transaction value of China mother care market exceeded RMB23.48 billion and China 3C home appliance B2C market was RMB107.88 billion; China clothing B2C market was RMB91.62 billion ($14.91 billion) with an increase of 54.2% from the same period of prior year according to data from EnfoDesk. All these added powerful strength for rapid growth of China online shopping market in Q3 2014.

China C2C market is featured with various categories and large number of products which can meet online shoppers’ personalized needs. E-commerce also pay attention to C2C market. Paipai.com, part of Jingdong, is launching micro-shop platform for both business and individual sellers targeting C2C mobile shopping market. China B2C and C2C markets will both develop steadily.

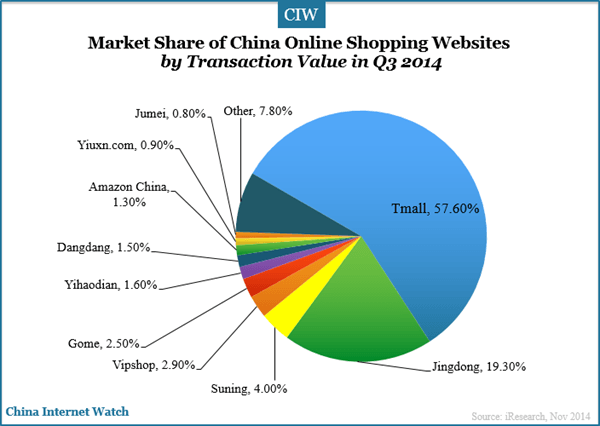

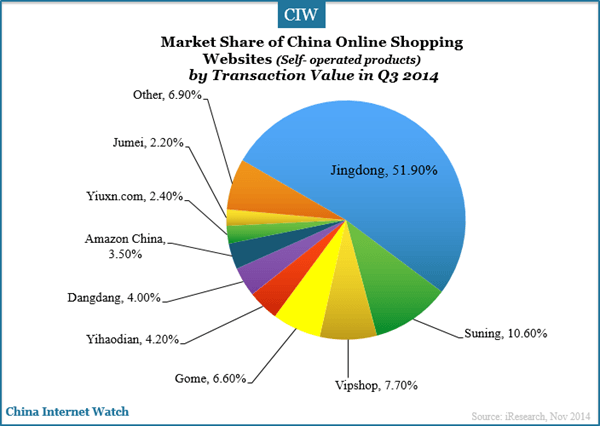

In China B2C market, Tmall represented 57.6% market share by transaction value in Q3 2014, ranking top, followed by Jingdong(19.3%) and Suning(4%). In terms of online shopping websites with self-operated products, Jingdong accounted for 51.9% market share, followed by Suning and Vipshop in Q3 2014. Find out more on B2C performance in Q3 2014 here.

With Alibaba and Jingdong’s IPO, their standings have been confirmed in China online shopping market. Other e-commerce companies are positively making great efforts.

Related to Q3 2014 Performance in online shopping: Jingdong, Alibaba, Dangdang, Vipshop, GOME.

Also read: Chinese Consumers STRONG Intention for Online Purchase with Higher Buying Rates Than Browsing