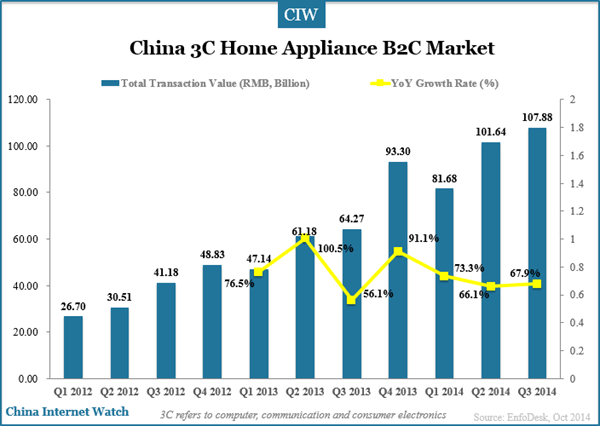

In Q3 2014, total transaction value of China 3C home appliance B2C market was RMB107.88 billion ($17.56 billion) with an increase of 67.9% from the same period of the prior year.

In Q3 2014, Suning launched new channels of “Big party” & “Shanpai” on its platform which drove up its sales. Overall, China 3C home appliance B2C market had stable growth in Q3 2014. In category of major home appliance and kitchen appliance, Midea ranked top among all the brands on Tmall/Taobao in September 2014.

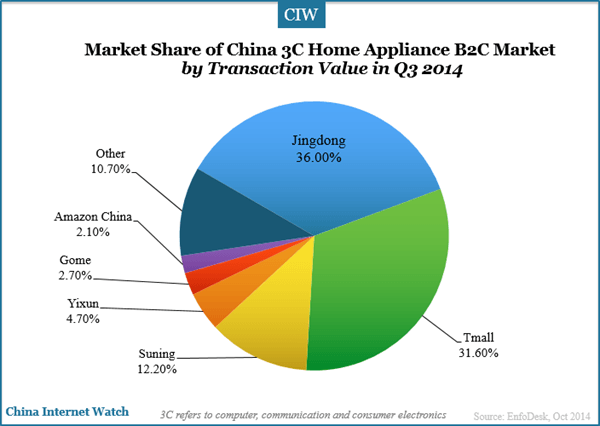

Jingdong represented 36% market share in Q3 2014, followed by Tmall and Sunning.

Here are the highlights in China 3C home appliance B2C market:

- There’s rapid growth in traditional home appliance, such as refrigerator, washing machine, air condition and FPD (Flat Panel Display). The demand for dust purification equipment, personal care equipment and functional kitchen appliance in China is increasing nowadays.

- China 3C home appliance B2C e-commerce companies have high standards about delivery, home installation and after-sales service. For example, Suning and Gome have complete service system for online selling. Tmall purchased RRS.com (a website of Haier Group) which strengthened home appliance delivery service. Jingdong not only has self-logistics system but also provides extra service like “refund goods within 30 days without a reason”.

- Penetration of online shopping for major home appliance is still low and there is great potential in tier-3 & tier-4 and lower cities in China. Besides, the competition among China home appliance e-commerce companies will be more fierce.

Also read: INFOGRAPHIC: China’s Top 30 B2C Websites