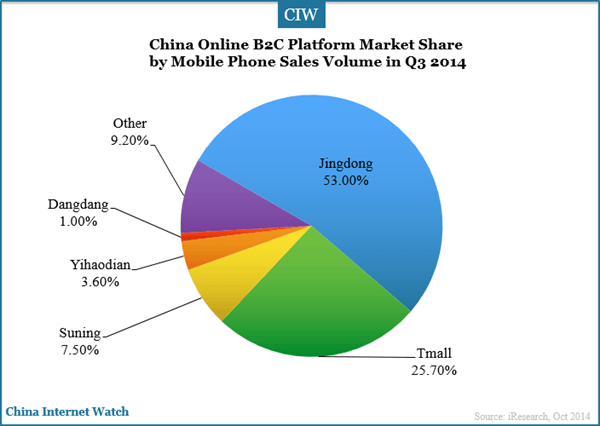

In China mobile phone B2C market, Jingdong, Tmall, Suning, Yihaodian and Dangdang accounted for over 90% of market share by sales volume in Q3 2014. Sales volume of Jingdong and Tmall combined accounted for over 80% market share; and Jingdong accounted for 53%.

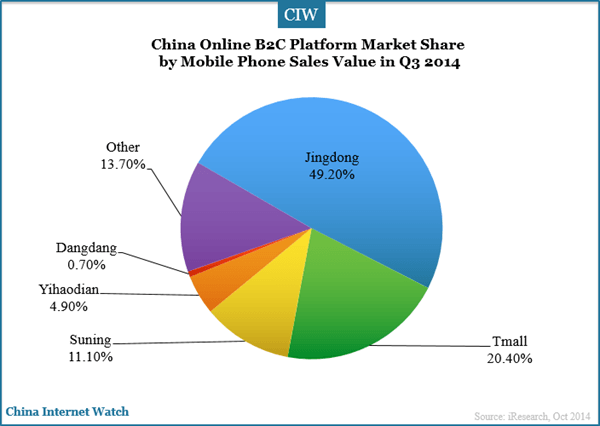

By sales value, Jingdong, Tmall and Suning together accounted for over 80% in China mobile phone B2C market in Q3 2014. Jingdong ranked top in China mobile phone B2C market by sales volume and by sales value in Q3 2014.

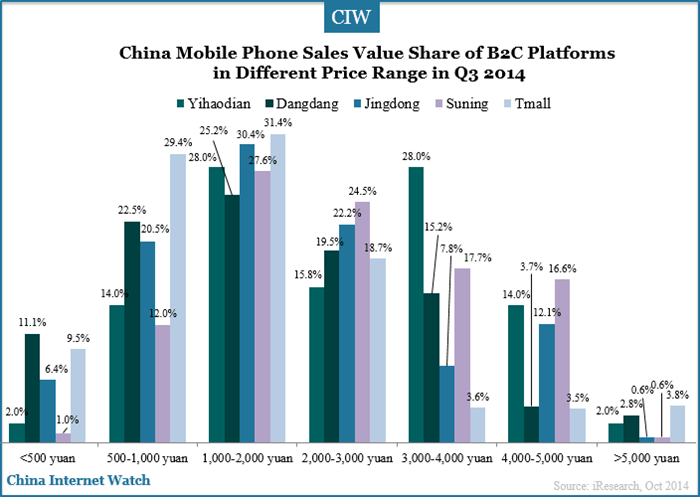

From different price ranges of China mobile phones, 30.4% market share by sales value of Jingdong were from mobile phones priced between 1,000 and 2,000 yuan; 22.2% were from ones between 2,000 and 3,000 yuan.

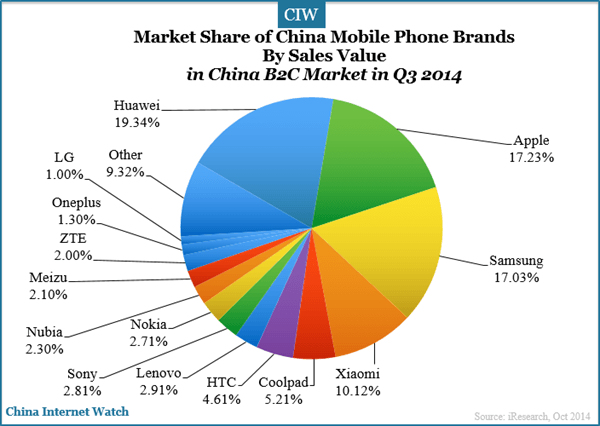

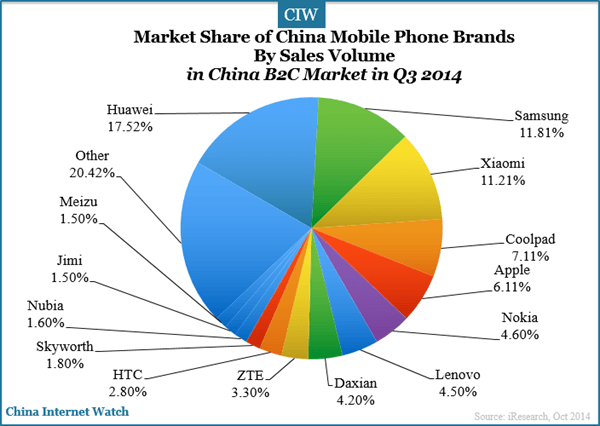

There were over 250 mobile phone brands in China mobile phone B2C market in Q3 2014 and total transaction value was RMB10.2 billion ($1.66 billion). Huawei, Apple, Samsung and Xiaomi accounted for over 60% of market share by sales value and Huawei ranked top, followed by Apple, Samsung and Xiaomi according to iResearch. The competition in China mobile phone B2C market is fierce.

Only Huawei, Samsung and Xiaomi each had over 10% market share by sales volume in Q3 2014. Among China mobile phone brands with sales value over RMB100 million ($16.35 million), Apple, LG, Sony, OnePlus, HTC, Nubia, Meizu and Samsung were ones with high average price. As Coolpad mobile phone’s price were lower than average price in China mobile phone B2C market in Q3 2014, it’s the fifth largest mobile brand by sales value though its sale volume was fourth.

Also read: PwC: 77% Chinese Buying Products on Mobile Phones