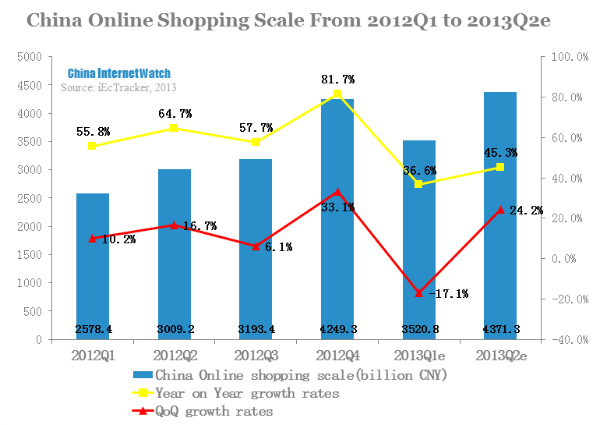

According to iResearch report in Q2 2013, China’s online shopping market turnover was about 437.13 billion yuan (USD 70.86 billion), increasing 45.5% compared to last year.

As the National Bureau of Statistics of China report shows, the total retail sales of consumer goods reached 6.03 trillion yuan C(USD 977.5 billion) in Q2 2013, with 8.7% QoQ increase. Online shopping retail sales represented 7.3% total retail sales, and QoQ increase rate of online shopping retail sales was 2.78 times of consumer goods total retail sales.

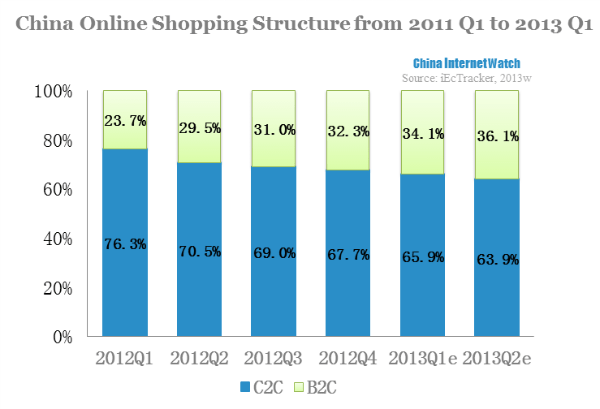

It is clearly that the C2C dominated the whole market with 63.9%, and B2C occupied 36.1%. B2B market share increased 2% compared to Q1. B2C had a 77.4% year-on-year increase, 2.4 times of C2C increase rate.

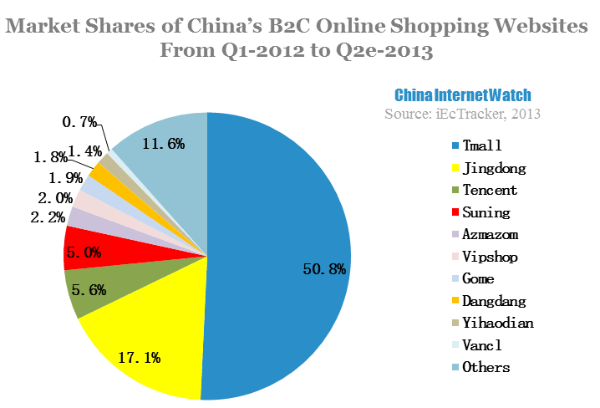

Tmall and Jingdong occoupied market with 67.9%. Compared to Q1, the market structure didn’t change too much. Tmall occupied 50.8% B2C market share. And Jingdong dominated in B2C market with 47%.

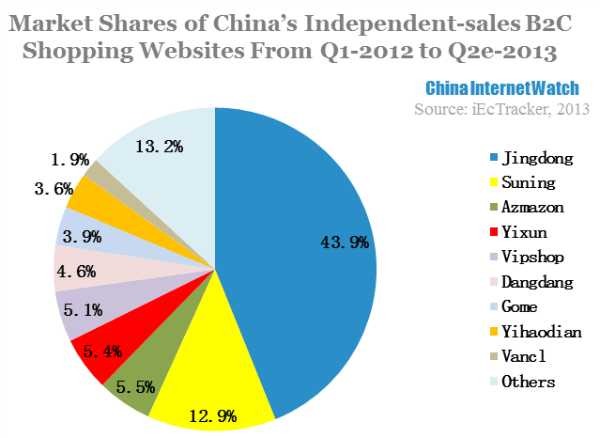

In Q2 2013, Jingdong occupied 43.9% share in B2C independent sales market, climbing slightly compared to Q1. Followed by Suning with 12.9% share.

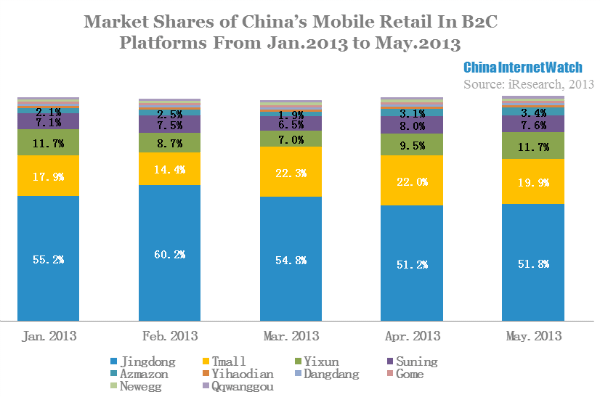

Jingdong dominated nearly the half of mobile market in 2013, but the sales volume dropped slightly in March. Tmall occupied mobile market with an average of 20%. Suning and Yixun led the second level of mobile market, together occupied about 20% market.