China Internet Stats, Trends, Insights

In 2020, China’s total retail sales of consumer goods reached 39,198.1 billion yuan, down by 3.9% over the previous year. The online retail sales in China reached 11,760.1 billion yuan, grew by 10.9% year on year.

China’s top e-commerce and retail are being integrated, a concept brought by Alibaba “New Retail”. This market category covers retail market from both traditional trends to emerging new business models on the digital space.

China e-commerce accounts for over 25% of its consumer retail sales in the first half of 2020.

E-commerce is very advanced in China. Chinese consumers buy products or services online expecting bonus gifts, great packaging, and fast delivery.

E-commerce platforms in China such as Taobao, Tmall, JD, and Pinduoduo are the most common way businesses reach and sell to Chinese consumers online. Independent e-commerce websites are much less common than the rest of the world.

Some Chinese are also used to buy through Daigou agents who are usually Chinese residing overseas and buy in a foreign market and ship to China for a small fee.

Social media and live streaming have become top vehicles for driving e-commerce sales in China. Sales from Alibaba live streaming platform grew by 150% for 3 consecutive years.

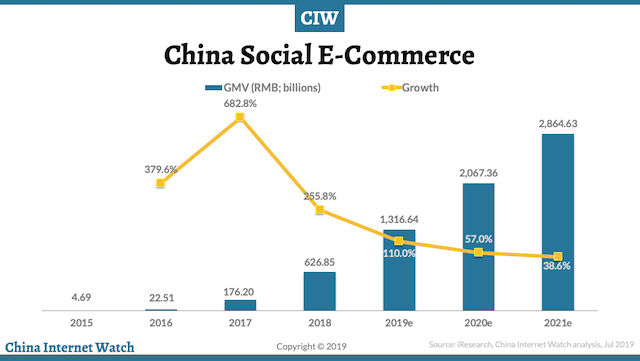

China Social E-Commerce

Social media continues to play an important role in China’s e-commerce market in the last three years.

Social e-commerce GMV reached 626.85 billion yuan in 2018 with an increase of 255.8%. It’s expected to continue the fast growth and exceed 1.3 trillion yuan in 2019 and 2.86 trillion in 2021.

Share of social e-commerce in China’s online shopping market expanded from 0.1% to 7.8% between 2015-2018. Important platforms in this sector include Pinduoduo, Xiaohongshu, WeChat (Haowuquan), and video broadcasting apps. Read the Art of Social E-Commerce that Xiaomi can teach you.

Chinese social e-commerce companies have been growing at a compound annual growth rate of 100.6%. Their penetration rate has increased to 11.9%. 80% of internet shoppers are using social e-commerce channels. The penetration rate of group shopping consumers has reached the highest at 57%.

Compared with the traditional model, the essence of social e-commerce is to leverage the role of individuals in the sales process. Through the decentralization of customers and services, it has better adapted to the challenges of the high customer acquisition cost, stressed platform growth and low loyalty of users that face the traditional e-commerce channels. Find out more here.

A community-based e-commerce platform penetrated 10 million households

China E-commerce Events

All e-commerce companies in China continuously run promotions and campaigns throughout the year. The largest shopping festivals in China are Double 11 (or Singles’ Day) in November and mid-year promotion 618 (August 18).

Other e-commerce events include Double 9 (9 Sep), Chinese New Year, Black Friday, and other important festivals and holidays.

Check out cross-border e-commerce in China here. Or, B2C market overview here (historical data).

Or, browser by China’s top e-commerce platforms: Taobao, Tmall, JD, Kaola, Vipshop, Xiaohongshu, Pinduoduo, Amazon China.

Download the latest Dossier on China E-Commerce market if you have a CIW Premium membership. Subscribe here.

China E-commerce Websites & Platforms

The leading e-commerce companies are Alibaba Group, Jingdong (JD), and Pinduoduo.

Alibaba leads China e-commerce market in B2B, B2C, and cross-border sectors. In B2B, it leads with Alibaba.com (English language for global B2B) and 1688.com (Chinese language for domestic SME B2B). In B2C, it leads with Taobao and Tmall.

Taobao is the largest B2C e-commerce website and platform in China, followed by JD.com and Pinduoduo. Pinduoduo started and stays a mobile-only shopping platform with the fastest growth in China’s lower-tier cities.

The top 3 mobile shopping apps, including Taobao, Pinduoduo, and JD, have a total number of 861 million unique users. The average monthly time spent on shopping apps grew by 35% YoY to 8.1 hours. See a more detailed comparison of these top shopping apps here.

These apps are particularly popular among the female demographic.

Top Articles on China E-commerce

3 popular models of social e-commerce in China

Alibaba launched Tmall Luxury Soho, targeting Gen-Z luxury shoppers

How Taobao’s social affiliate platform Taoxiaopu works

The gap behind China’s e-commerce factories

Pinduoduo and Taobao’s manufacturing strategies

Insights of e-commerce and manufacturing collaboration in China

Case study: selling luxury product through Taobao live broadcast

How Taobao uses search and content to cultivate social e-commerce

Tmall Hey Box: Alibaba’s best seller incubator for top brands

KFC & Ting Hsin’s attempts in membership e-commerce in China

Social e-commerce in China has much higher conversion rates than traditional ones

Ingredients to win omnichannel retail in China

Quick comparison of Xiaohongshu, Netease Kaola cross-border e-commerce users

User acquisition cost compared: Alibaba vs. JD vs. Vipshop vs. Pinduoduo

Can I sell to consumers in China via e-commerce?

Yes. There are several ways to do that. You can either list your products on China’s e-commerce platforms or start a mobile shop running on top of WeChat. You can run your own e-commerce website but the conversion rate will be very low if you don’t have a fast website or high brand awareness.

What are the popular payment gateways?

The most popular ones are Alibaba’s Alipay (officially under Ant Group) and Tencent’s WeChat Pay. You can also offer credit card payment options. But, credit card is not as popular; and, some domestic credit card may not be accepted.

How do I do cross-border e-commerce selling to Chinese?

Visit our CBEC section for details.